By JAMES KUNDA? –

By JAMES KUNDA? –

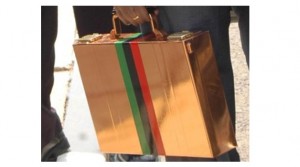

FINANCE Minister Alexander Chikwanda last Friday unveiled the K46.7 billion 2015 National Budget to Parliament with an assurance that Government was committed to uplifting the welfare of Zambians.

Government has increased the budgetary allocation from K42.6 billion in 2014 to K46.7 billion in the 2015 National Budget.

The Budget will be financed from domestic revenues to the tune of K35.1 billion which is 75.2 per cent of the total Budget, while K1.2 billion will be grant-aided from cooperating partners.

Domestic borrowing is projected to be at two per cent of the Gross Domestic Product (GDP) translating to K3.8 billion, while K4.2 billion will be a combination of foreign programme and project financing and K2.4 billion as proceeds from the 2014 Eurobond.

Prior to Mr Chikwanda’s presentation, various stakeholders made proposals on tax and non-tax measures to the Ministry of Finance regarding what they wanted to be included and excluded from the National Budget.

This was all in an effort to ensure that Government considered third party opinion on some of the development initiatives that when financed and strategically implemented, would provide benefits to the people.

Key in Mr Chikwanda’s Budget presentation were alterations to the existing mining fiscal regime, financing to critical sectors such as transport, energy and agriculture and incentives to promote the moribund local manufacturing industry.

The Bankers Association of Zambia (BAZ) says the Budget is growth-oriented due to an increase in allocations towards vital economic sectors such as transport.

BAZ chief executive officer Leonard Mwanza said the increased allocations towards sectors like roads, railway and energy among others would help spur economic growth.

‘‘The allocation to some of the growth sectors like energy, roads, and railway and tax reduction in Jet fuel will result in the reduction in the cost of doing business, because these sectors are the engine of economic development,’’ Mr Mwanza said.

He said the proposal by Government to spend K5.6 billion of the total Budget on road construction was one of the progressive factors that would result in the reduction in the cost of doing business in the country.

This will also help link the country internally and to neighbouring countries to ensure the smooth transit of goods to the market among other advantages.

Not all is rosy at present in the local mining industry as Government and the mines are at loggerheads regarding the Value Added Tax (VAT) refunds amounting to US$600 million owed to the mines by the State.

Mining companies have also persistently complained about the 10 per cent export duty charged on exports of sub processed materials such as copper and nickel concentrates.

Thus the announcement by Mr Chikwanda that Government had increased the mineral royalty threshold for open cast and underground mining operations in the 2015 Budget could not have come at an apt time as this one.

Open cast mining operations would be charged 20 per cent mineral royalty as the final tax, while underground operations get to pay eight per cent of their profits as the final tax or mineral royalty.

Mr Chikwanda said the decision was intended to achieve a more equitable distribution of mineral wealth between the government and the mining companies.

While some may agree with Mr Chikwanda’s position, Zambia Chamber of Mines president Jackson Sikamo expressed concern that the proposed new mining tax regulations would affect capital investments in the industry.

Mr Sikamo during a post-budget analysis in Lusaka recently, stated that the new mineral royalty tax was high and would stifle mining operations as it required to be paid monthly even where no cash has been generated.

Mr Sikamo who has since called for more dialogue on the matter contended that mineral grades are becoming lower, making mining more sophisticated, hence the mineral royalty fee should have been more relaxed.

‘‘It will be difficult for the Zambia Revenue Authority (ZRA) to differentiate between minerals from open pit and underground mining because some companies own underground and open pit mines”.

‘‘If you do not invest you still pay royalty tax provided you own a mine, that is why it is difficult to create employment because the government is not encouraging investments,” he said.

Former Finance minister Ng’andu Magande expressed hope that the new mining tax system would increase revenue collection for the Government.

His statement was in line with that of European Union (EU) head of delegation to Zambia Gilles Hervio who said the new mining tax regime would not have a negative impact on the mining industry.

As Mines, Energy and Water Development Minister Christopher Yaluma stated, there is still room for dialogue on the tax regime as it should be one that creates a win-win situation for the investors and Zambians.

Government has also proposed the removal of the five per cent customs duty on Jet A-1 fuel, a move that stakeholders like the Union Gold Zambia have praised as it will expand the tourism sector.

Union Gold Zambia chairperson Mark O’Donnell said he was pleased to note that the Government has in the 2015 Budget addressed aviation fuel, which has been impacting negatively on growth of tourism sector.

‘‘The tourism industry is also affected by the European Union (EU) aviation ban. Without cheaper affordable airline in and outside the country, growing tourism is going to be difficult to achieve,” Mr O’Donnell said.

Mr O’Donnell said since the departure of British Airways and KLM on Zambian route, for the first time in more than 60 years, Zambia had no direct flight to Europe, due to the high cost of aviation fuel.

‘‘I am pleased to note this has been recognised and a five per cent customs duty has been taken off the aviation fuel. It is essential that we develop new routes in Zambia that makes it cheaper and affordable for travelers,’’ he said.

Government has continued to invest heavily in infrastructure such as energy to ensure that the country makes the most of its potential in the manufacturing industry.

In the Budget, K600 million has been allocated to ZESCO to enhance power generation, transmission and distribution services.

Further, K70.7 million has been allocated to the Rural Electrification Authority (REA) to increase the number of rural communities connected to the national grid.

This is in addition to other forms of financial support that the company has received from government in the recent past including slightly more than $100 million from the $750 million Eurobond accessed in 2012.

Zambia Consumer Association (ZACA) executive director Samuel Simutunda in reacting to the pronouncement on ZESCO said his association expected the power utility company to improve service delivery.

Mr Simutunda said at present, consumers in some parts of the country were still experiencing intermittent power outages and this was a deterrent to the smooth flow of business.

“There is a rapid demand for electricity currently due to massive economic activities and it is clear from the allocation towards power generation in the 2015 National Budget that Government is alive to this fact, ZESCO therefore need to ensure that the projects are implemented promptly to maximize or totally reduce load shedding,” he said.

Mr Simutunda said the power utility could also, during off peak hours, extend electricity supply to neighbouring countries in deficiency and earn the country much needed foreign exchange.

Power generation and supply is about 1,780 Mega Watts (MW) and with the financing readily available, the company expects to increase this capacity to more than 2,000 MW before the end of the year.

The initiative to light up rural Zambia is also a welcome initiative especially with the ongoing establishment of industrial clusters by the Citizens Economic Empowerment Commission (CEEC).

Agriculture plays an integral part in the development of any economy, thus the allocation of funds towards the Farmer Input Support Programme (FISP) and the e-voucher is a welcome development.

In the 2015 Budget, Government has set aside K 1.1 billion for the FISP to benefit one million farmers while K254.9 million has been allocated to the e-voucher system.

The participation of more farmers in the FISP is a recipe for increased production in crop farming thus the country should position itself for a maize harvest similar to the 3.3 million tonnes from the?last farming season.

The e-voucher has flopped in the last two years and with the kind of money set aside for the scheme next year, the necessary procedures should be implemented early enough to change the status quo.

Further, K992.9 million will be spent by the Food Reserve Agency (FRA) in securing the strategic grain reserves with 500,000 tonnes of maize from small-scale farmers.

This, Mr Simutunda said was positive the move as financing the agriculture sector was a way in which the country could remain self sustainable and food secure thereby maintaining its status as a regional food basket.

“Financing the agriculture sector is always a positive move that will enhance productivity of crops to ensure food security. It is also a good way to diversify from mining and this is why market access for crop produce should be made even easier” he said.

Mr Simutunda said the allocation of K164 million towards the construction of dams for irrigation and other incentives to support the aquaculture sector will ensure that the country maximises benefits from the water endowment.

Initiatives to promote growth in the local manufacturing industry have also been supported by stakeholders with the Zambia Association of Manufacturers (ZAM) saying the proposed increase in customs duty on roofing sheets to 30 per cent will promote value addition and stimulate investment in the local steel manufacturing industry.

ZAM chief executive officer Maybin Nsupila said that the move to increase customs duty on roofing sheets will create jobs for people in steel manufacturing.

“The pronouncement by the minister regarding the customs duty on roofing sheets will promote value addition from the lower levels and increase investments that would in-turn spur employment opportunities in the industry,” he said.

Mr Nsupila said ZAM also supported the proposed 25 per cent increase on customs duty for explosives as this was an incentive for the local manufacturing industry maximise on production.?Meanwhile, Mr Nsupila said the directive by Mr Chikwanda that government departments should source locally produced goods is a welcome measure that will drive the growth of the manufacturing industry.

“Government departments such as education for example, have been importing desks even when the local industry has the known capacity to produce these items hence, the directive by the minister on government departments’ sourcing locally is a move in the right direction,” he?said.

Private Sector Development Association (PSDA) chairperson Yusuf Dodia, however, felt that the 2015 National Budget does not encompass enough incentives to support the growth of the private sector participating in the economic cycle.

Mr Dodia noted that the budget did not highlight what measures would be implemented to help the private sector thrive in sectors such as tourism and mining.

“The 2015 Budget has not clearly outlined the growth of the private sector in areas such as tourism and mining and these are critical to the growth of the economy,” he said.