By JAMES MUYANWA –

THE K46.7 billion 2015 National Budget which was presented to Parliament yesterday looks balanced.

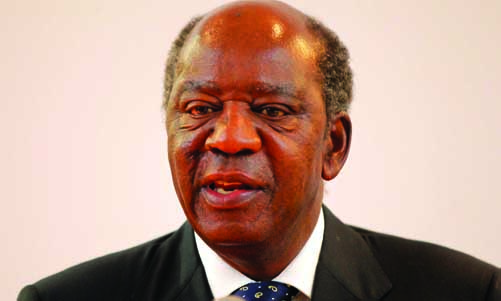

In coming up with his fourth Budget since the Patritotic Front (PF) came into the office in 2011, Finance Minister Alexander Chikwanda seems to have been evenhanded in reconciling the scarce resources and the ever-unlimited needs.

The question of resources has become even more imperative considering that more than 88 per cent of the total funds or K41.3 billion of the K46.7 billion required to fully implement this financial plan will be locally sourced.

Following Zambia’s attainment of the lower middle-income country status more than three years ago, the cooperating partners have been reducing their financial support to the country while concession loans have become rarer.

Therefore, it has become of essence to engage in balancing acts between the needs and resources as well as among the competing areas of expenditure.

For instance, to ensure mitigation between wage the bill and public service workforce, the Government has maintained the freeze it placed on the public service salary increase while on the other hand effecting the recruitment of public service workers.

Another area where balancing is seemingly at play is in the mining sector where Mr Chikwanda has introduced a new tax regime which will enable the tax collector, Zambia Revenue Authority (ZRA), to collect more taxes from the mines.

To balance that act, the Government will, most likely, amend the contentious ZRA Value Added Tax (VAT) Rule Number 18 to relax the requirements for refunds.

If amended, the rule, which has resulted into the Government withholding the refund of US$600 million, will enable the easy recovery of the funds by the affected mines, thereby mitigating the effects of the new tax regime.

Elsewhere, it is also superb that the Government has decided to lead by example in observing the Lusaka Stock Exchange (LuSE) requirement that no single shareholder should have more than 75 shares in any firm.

By deciding to reduce its shareholding level in the ZCCM-Investment Holdings to 60 per cent and offer the 27 per cent shares to Zambians, the Government has scored a double.

It has shown its adherence to good corporate governance while at the same time endeavouring to economically empower its own people.

In terms of sector allocations, the K587 billion proposed for the Local Government Equalisation Fund seems to be a good start towards fiscal decentralisation.

This will bolster the efforts toward the long-awaited and much-talked-about decentralisation, more so since the allocation will be based on the revenue collected within the local jurisdiction.

Following the creation of 32 new districts and one province in the country, the allotment of the K500 million for the carry-over of infrastructure development in these areas is a step in the right direction.

Under economic affairs, the K5.6 billion apportioned towards the road works look too colossal but massive also are the road projects which are going on in the country.

At the end of these roads’ construction, Zambia will boast of having come up with the most expensive single road project in Africa in the Mongu-Kalabo Road.

Another remarkable allocation is what has been made towards the agriculture sector where the Farmer Input Support Programme (FISP) is earmarked to receive K1.1 billion.

A further K255 million will be for E-voucher System for farmers in the input they receive and another K993 million for strategic food reserves.

In line with President Michael Sata’s speech when he officially opened the current parliamentary session, the Ministry of Finance proposes to spend K650 million on the construction of additional student hostels at three public universities and one college.

This will help ease the accommodation shortage among students and, related to that, is the increase in the allocation for bursaries from the current K156 million to K200 million.

Given the current demand for bursaries at the universities, however, the increase seems to be too low to help redress the situation.

Under the revenue estimates and measures, the doubling of the presumptive tax payable by individual operators of public service vehicles is seemingly too much.

Albeit it has not been adjusted for the past decade, the increase should have been staggered over some years.

Various stakeholders have been calling for the increase of the specific duty on refined edible oil to encourage the consumption of local products and safeguard the local manufacturers.

The increase of duty to K2.20 per kilogramme from the current 85 ngwee, for that reason, is definitely uplifting to these stakeholders.

Heartwarming to local manufacturers too is the increase of customs duty on explosives from the current 25 to 30 per cent.

The removal of the five per cent customs duty on jet fuel will help attract more airlines to introduce routes to Lusaka and other international airports in the country.

This will help in transforming Lusaka as a regional hub for most of the airlines while at the same time attracting tourists to the country.

Given the incessant outcry on the current mines’ contribution towards the local economy, the review of the current mining tax regime has been inevitable.

It can only be hoped that the redesigning of the mining tax regime will address most of the concerns which have been raised on the contribution of the mines.

Truly, it has been bold of the Government to go ahead and effect this tax regime which will see the national coffers gain additional K1.7 billion next year.

What is unknown, however, is if there are any means to ascertain the source of the final metals, whether from the open pit or from the underground mining for the new mineral royalty purposes.

It will be interesting to learn what mechanism the Government has put in place to curb cheating by mines, especially those operating both open pits that will attract 30 per cent mineral royalty, and underground mines which will only attract eight per cent.

What would prevent mines from cheating by over-declaring the output from underground mines and under-declaring those from the open pit mining?