By DELPHINE ZULU –

TRANSPARENCY International Zambia (TIZ), has appealed to President Michael Sata to dismiss all Chief Executive Officers (CEO) cited for financial irregularities in the 2012 Parastatals Audit General Report.

The organisation had also demanded for clear and drastic action on the 2012 Parastatals Audit General Report.

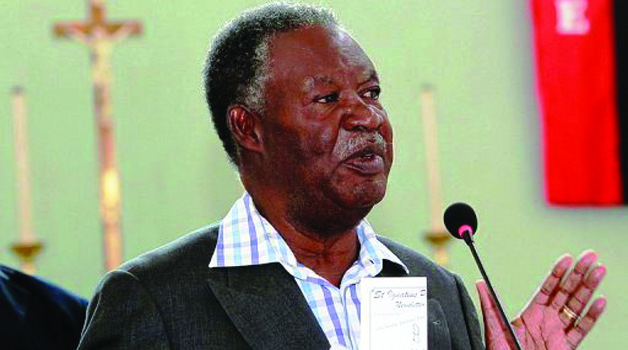

TIZ executive director Goodwell Lungu said the dismissal of the CEOs cited in the 2012 Parastatals Audit General Report for financial irregularities should be effected in line with the law because they were a big risk to protecting public funds meant for the benefits of citizens.

Mr Lungu also demanded immediate action to be taken on all irregularities cited in the 2012 audit report of accounts of parastatal bodies.

Mr Lungu said TIZ had noted with grave concern that the 2012 Auditor General’s Report clearly concluded that there was failure to produce financial statements, poor management of contracts, poor financial perfomance, poor administration of loans and advances and questionable investments in Zambian parastatals.

He said TIZ wondered how such irregularities could be allowed to go on if drastic measures were not taken and demanded for clear and decisive action from law enforcement agencies so that those cited should face the law.

Mr Lungu also demanded thorough probe in the breaches of contract at Indeni Pretroluem Refinery Company and bring all culprits to book and ensure that funds were recovered for the company’s failure to produce various stores procured in 2012 which had not been received as of December 2013 totalling to K204,599,129.

He said the report confirmed that the contract for the Zambia Development Agency (ZDA) director general revealed that he was to be receiving donor funded monthly income amounting to US$2, 000 in addition to his salary and yet clause 5.2 of the contract exempted the additional monthly income from Pay as You Earn (PAYE) tax.

“Clause 5.2 of the director general’s contract exempted the additional monthly income from Pay As You Earn (PAYE) tax. The exclusion of that portion of his emoluments from being taxed is a contravention of CAP 323 of the Laws of Zambia, Income Tax Act schedule II, which does not include such incomes and such officers among tax exempt incomes and office bearers,” he said.

He also said the latest report indicated that a total of US$60, 000 from May 2011 to October 2013 was paid to the Director General without deducting and remitting PAYE to the Zambia Revenue Authority (ZRA).

Mr Lungu said this confirmed that although the contract stated that the director general was to be paid the additional monthly income from donor funds, there were no donor funds received during the stated period but instead the director general was paid from ZDA funding from funding received from Government and no taxes were deducted.

He said it was also reported that on July 30, 2012 a Citizens Economic Empowerment Commission (CEEC) director empowerment was paid car maintenance allowance amounting to K13,860,000 despite having been provided with a CEEC vehicle contrary to Clause 16.2.2 terms and conditions of service.